The Dream and The Drain

Owning a home is a cherished dream for many, a symbol of stability and achievement. However, this dream often comes with a long-term financial commitment: the home loan. While Equated Monthly Installments (EMIs) make homeownership accessible, the silent giant accompanying these loans is the colossal interest amount paid over decades. Imagine taking a ₹50 lakh home loan; it’s not uncommon to end up paying almost double that amount, or even more, by the time the loan tenure concludes. This staggering interest outgo can feel like a relentless drain on your hard-earned money, significantly impacting your long-term financial health and freedom. Many homeowners resign themselves to this fate, unaware that a straightforward, yet incredibly effective, strategy exists to combat this interest burden. What if I told you there's a simple trick, a method so accessible that anyone can implement it, which personally saved me a jaw-dropping ₹40 lakhs in interest payments on my ₹50 lakh home loan? It’s not financial wizardry, nor does it require a hefty, one-time windfall. This post will unveil this very strategy, guiding you through how you too can potentially save lakhs, shorten your loan tenure, and achieve debt freedom much sooner than you ever thought possible. Prepare to transform your home loan from a lifelong burden into a manageable stepping stone towards true financial independence.

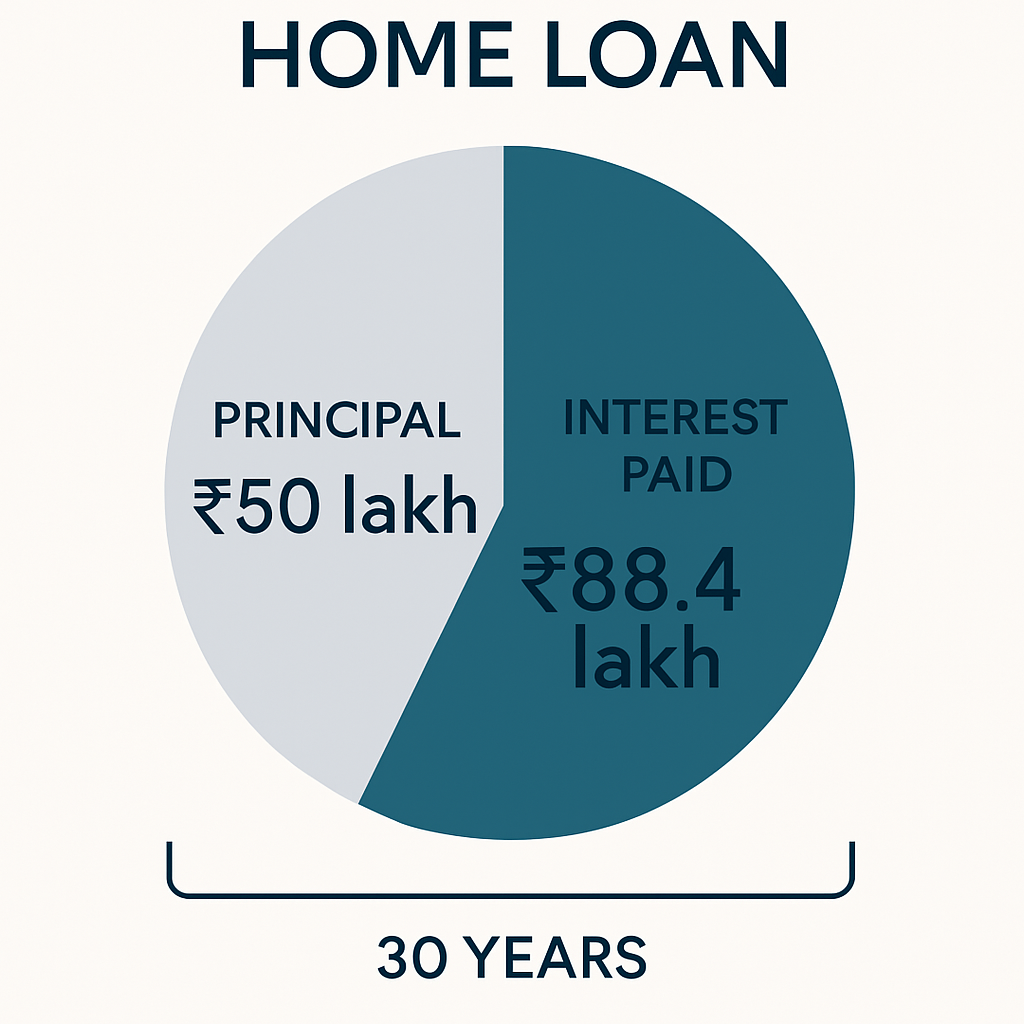

The Shocking Reality of Home Loan Interest

Let's delve into the numbers to truly grasp the magnitude of home loan interest. Consider a typical home loan of ₹50 lakhs with an interest rate of, say, 8.5% per annum, and a tenure of 30 years. The monthly EMI for this loan would be approximately ₹38,447. Now, if you diligently pay this EMI for the entire 30-year period, the total amount you would pay back is ₹38,447 multiplied by 360 months (30 years), which equals a staggering ₹1,38,40,920. Subtract the principal loan amount of ₹50 lakhs, and you are left with ₹88,40,920 paid purely as interest! That’s nearly 1.77 times the original loan amount. This interest component often dwarfs the principal, meaning for a significant portion of your loan tenure, especially the initial years, your EMIs are predominantly servicing the interest rather than reducing the principal. This is the harsh reality for millions of homeowners who stick to the standard repayment schedule. The long tenure, while making EMIs affordable, becomes a breeding ground for massive interest accumulation. This financial drain doesn't just impact your savings; it curtails your ability to invest, pursue other life goals, or build wealth. Understanding this fundamental mechanism of how loan interest works is the first crucial step towards devising a strategy to counteract it and take control of your financial future. The good news is, you don’t have to be a passive observer in this process.

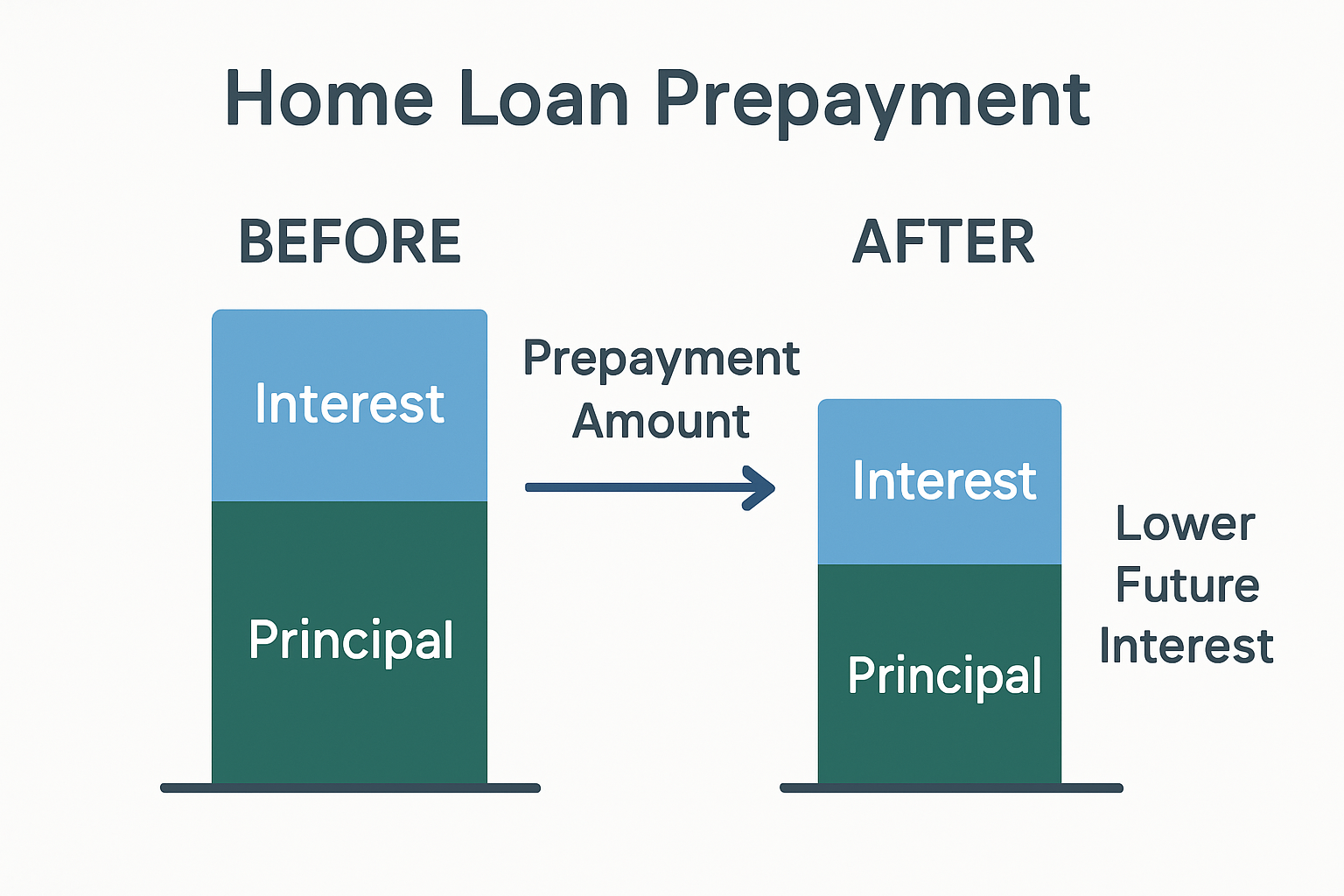

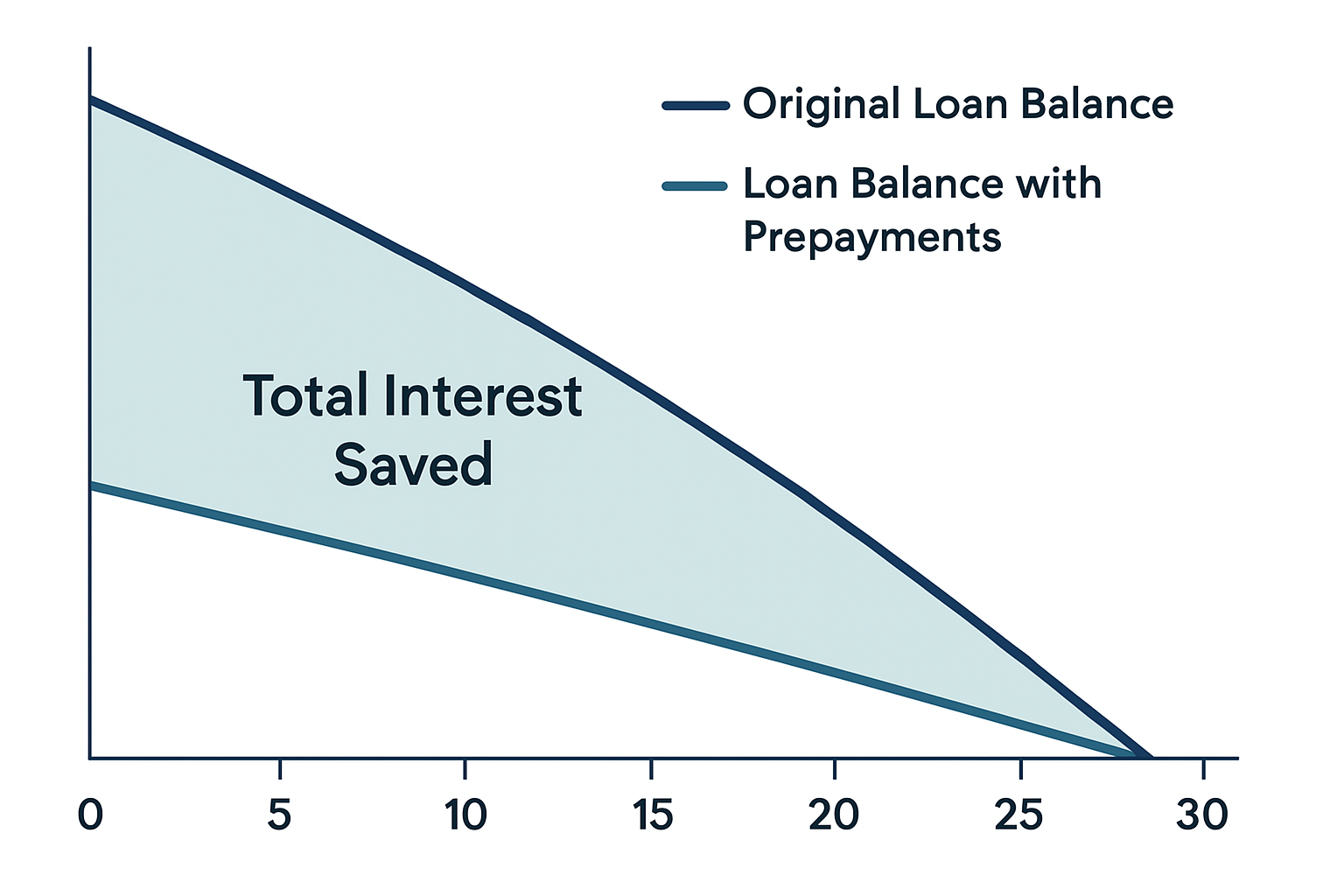

Understanding Home Loan Prepayment

Home loan prepayment is the act of paying an amount towards your home loan that is over and above your regular EMIs. This additional payment goes directly towards reducing the outstanding principal amount of your loan. Since interest is calculated on the outstanding principal, any reduction in the principal leads to a corresponding reduction in the future interest payable. There are primarily two types of prepayment: full prepayment, where you pay off the entire outstanding loan amount in one go, and partial prepayment, where you pay a smaller, additional sum at various intervals. While full prepayment might be an option for a few, strategic partial prepayments are a more accessible and powerful tool for the majority. The beauty of prepayment lies in its compounding effect in reverse; instead of interest compounding against you, your prepayments work to shrink the principal faster, thereby reducing the base on which future interest is calculated. This not only saves you a significant amount of interest but can also drastically shorten your loan tenure. For instance, even a small, consistent partial prepayment can shave off years from your loan term. Financial institutions are generally amenable to prepayments, though some may have clauses regarding minimum prepayment amounts or nominal prepayment charges, especially on fixed-rate loans (though RBI guidelines have largely removed prepayment penalties on floating-rate home loans for individuals). Understanding the terms and conditions of your specific loan agreement regarding prepayment is essential before you begin. This simple mechanism is your primary weapon in the fight against mounting loan interest.

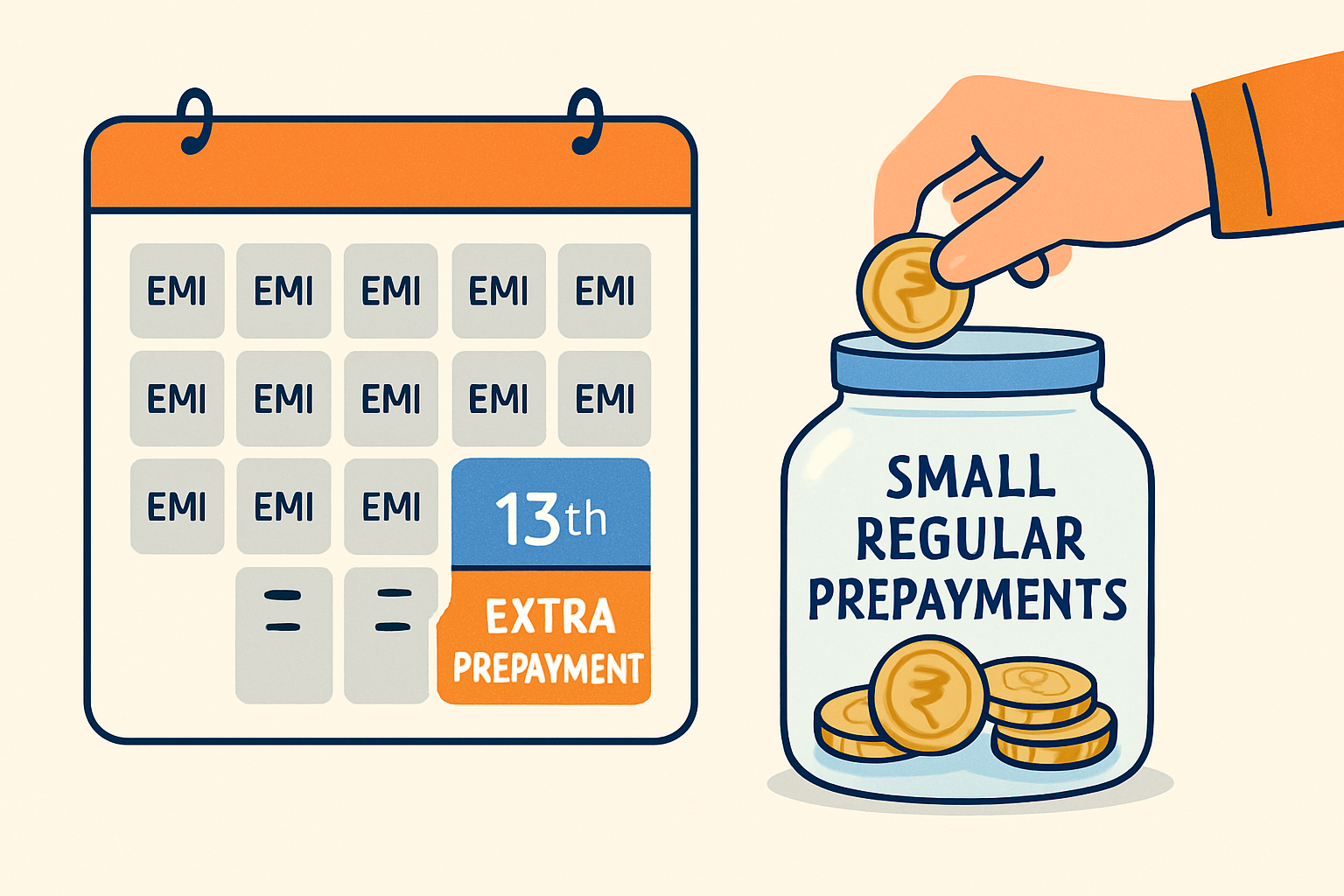

The "Simple Trick" Unveiled

The "simple trick" that led to my substantial savings isn't a complex financial maneuver; it's the disciplined strategy of making consistent, manageable partial prepayments, specifically aiming to pay at least one extra EMI's worth each year, and if possible, slightly more through strategic small additions. Here’s how it works: instead of just paying your standard EMI, you consciously decide to pay an additional amount towards your principal whenever feasible. For many, the easiest way to conceptualize and implement this is to aim to pay the equivalent of a 13th EMI in a year. This could be done by dividing one EMI amount by 12 and adding that small sum to your monthly EMI, or by making a lump-sum prepayment once a year (perhaps using a bonus or an increment). However, the real magic happened for me when I combined this with an even more proactive approach: identifying small, regular opportunities to increase that prepayment. For example, if my EMI was ₹38,447, I aimed to prepay this amount annually. But I also rounded up my regular EMI payments slightly, say to ₹39,000, channeling an extra ₹553 monthly directly to principal. Furthermore, any small windfalls – a tax refund, a performance bonus, or even savings from cutting down discretionary expenses – were channeled towards prepayment. The key is consistency and making these prepayments as early in the loan tenure as possible, because that’s when the principal is highest and the interest-saving impact is most profound. This isn't about making huge sacrifices; it's about smart financial discipline and redirecting small, manageable amounts that collectively make a massive difference. This proactive, multi-pronged approach to partial prepayment is the core of the strategy. It’s simple because it doesn’t require a large one-time sum, and it’s powerful because of the compounding effect of these regular principal reductions. Understanding how to save interest on home loan is the first step.

My Journey: From Burden to Savings

Let me walk you through my personal experience with the ₹50 lakh loan I mentioned earlier, which had a 30-year tenure and an 8.5% interest rate. Initially, I was looking at a total interest payment of around ₹88.4 lakhs. The thought was daunting. After the first year of diligently paying my EMIs (approximately ₹4.61 lakhs, of which a massive chunk, around ₹4.23 lakhs, was just interest!), I decided to implement the strategic prepayment trick. I committed to paying one extra EMI (around ₹38,500) annually. Additionally, I started rounding up my monthly EMI by about ₹1,500 (channeling an extra ₹18,000 per year). So, my total annual prepayment started at roughly ₹56,500. In years where I received a modest bonus, say ₹50,000, I’d put at least half of that, ₹25,000, into the prepayment. So, in some years, my prepayment went up to ₹81,500. I used a home loan prepayment calculator frequently to see the impact. The results were astounding. Within the first five years of consistently applying this strategy, I had already knocked off several years from my loan tenure and saved a significant amount in projected interest. As I continued this, the snowball effect became more apparent. The principal was reducing faster, so more of my regular EMI was going towards principal, and my prepayments were making an even bigger dent. Fast forward, and by projecting the impact using reliable calculators and tracking my actual progress, I was on track to clear my loan approximately 12-15 years earlier and, crucially, save close to ₹40 lakhs in interest payments. This wasn't achieved by winning a lottery, but by the disciplined application of small, consistent additional payments. It required a mindset shift – viewing any surplus cash not as an opportunity for immediate spending, but as a tool to buy back my financial freedom from the loan. The feeling of watching my loan balance shrink rapidly and the interest meter tick down slower was incredibly empowering.

Beyond the Obvious: The Ripple Effect

The most significant benefit of home loan prepayment is, of course, the massive interest saved. However, the advantages extend far beyond just the monetary savings. Firstly, there's the drastic reduction in loan tenure. Imagine being debt-free 10, 12, or even 15 years earlier than planned! This opens up a world of possibilities. The funds that would have gone towards EMIs can now be redirected towards other crucial financial goals: retirement planning, children\'s education, travel, or investments that generate wealth rather than service debt. Secondly, there\'s immense psychological relief. Being free from a large debt like a home loan brings unparalleled peace of mind. It reduces financial stress and allows you to make life choices with greater freedom, unburdened by the thought of a long-term liability. Thirdly, owning your home outright, much earlier than anticipated, provides a solid asset base and enhances your net worth significantly. This financial security is invaluable. Moreover, a track record of diligent repayments and proactive prepayments can positively impact your credit score, making future credit more accessible and affordable if needed. The ability to reduce home loan tenure isn\'t just about numbers; it\'s about reclaiming years of your life from financial obligation, empowering you to live more fully and securely. The ripple effects of this simple trick touch almost every aspect of your financial well-being.

Navigating the Path: Common Pitfalls

While the benefits of home loan prepayment are substantial, it\'s crucial to navigate this path wisely to avoid potential pitfalls. One common mistake is not checking the terms and conditions of your loan agreement regarding prepayment charges. While floating-rate loans for individuals usually don\'t have prepayment penalties as per RBI guidelines, fixed-rate loans or loans from certain housing finance companies might still levy a charge. Always clarify this with your lender. Another pitfall is neglecting your emergency fund. Before you start aggressively prepaying your home loan, ensure you have a robust emergency fund (typically 6-9 months of living expenses) in place. Liquidating this fund for prepayment could leave you vulnerable in case of unforeseen circumstances. Similarly, don\'t sacrifice other critical long-term investments, like retirement savings or essential insurance coverage, solely for prepayment. A balanced approach is key. Some individuals also make sporadic, unplanned prepayments without a clear strategy. While any prepayment helps, a consistent, planned approach, even with smaller amounts, often yields better long-term results. Using a housing loan part payment calculator can help you visualize the impact of different prepayment scenarios and formulate a consistent plan. Lastly, be mindful of the source of funds for prepayment. Avoid taking on other high-cost debt (like personal loans or credit card debt) to prepay your home loan, as this would be counterproductive. The goal is to reduce your overall debt burden and interest outgo, not just shift it around.

Crafting Your Prepayment Blueprint

Ready to start your journey towards significant interest savings? Here’s a step-by-step guide to crafting your personal home loan prepayment blueprint:

1. Understand Your Loan Deeply: Begin by thoroughly reviewing your home loan statement and agreement. Note down your outstanding principal, current interest rate, remaining tenure, and, crucially, any terms related to prepayment (minimum amount, charges, frequency allowed).

2. Assess Your Financial Health: Evaluate your income, expenses, existing savings, and other financial commitments. Determine how much surplus you can realistically allocate towards prepayment each month or year without straining your budget or neglecting other essential financial goals like building an emergency fund or investing for retirement.

3. Set Clear Prepayment Goals: Decide on your prepayment strategy. Will you aim for one extra EMI per year? Will you increase your monthly EMI by a fixed amount? Or will you channel windfalls like bonuses? Having a clear, achievable goal will keep you motivated.

4. Utilize a Prepayment Calculator: This is a critical step. Use a reliable home loan prepayment calculator to simulate different prepayment scenarios. Input your loan details and experiment with various additional payment amounts and frequencies. This tool will show you exactly how much interest you can save and how many years you can reduce from your tenure. This visualization is a powerful motivator and helps in making informed decisions about how much to prepay.

5. Automate if Possible: If you decide to increase your monthly EMI contribution, try to automate this additional payment if your bank allows, or set up a recurring transfer to a dedicated account from which you make manual prepayments. Automation ensures consistency.

6. Inform Your Lender: When making a partial prepayment, ensure you instruct the lender to adjust it against the principal amount and request them to either reduce the EMI or the tenure. Most people prefer tenure reduction to maximize interest savings. Get a revised amortization schedule post-prepayment to see the impact.

7. Track and Review Regularly: Periodically review your progress. Are you meeting your prepayment goals? Has your income increased, allowing for larger prepayments? Re-evaluate your strategy annually or when significant financial changes occur. Continue using the calculator to stay on track and motivated by the visible progress.

The Unsung Hero: Prepayment Calculator

In the quest to save interest on home loan and reduce home loan tenure, one of the most invaluable tools at your disposal is the humble yet powerful home loan prepayment calculator. This digital tool might seem simple, but its ability to provide clarity and foresight is transformative for any borrower looking to optimize their repayment strategy. So, what makes it such an indispensable ally? Firstly, it demystifies the complex calculations involved in loan amortization and the impact of prepayments. Instead of guesstimating, you get precise figures on interest saved and tenure reduced for any given prepayment amount. This empowers you to make data-driven decisions rather than relying on vague notions. Secondly, a housing loan part payment calculator allows for scenario analysis. You can experiment with different prepayment amounts – a small monthly increase, a quarterly lump sum, or an annual bonus. By comparing these scenarios, you can identify the most effective strategy that aligns with your financial capacity. This experimentation costs nothing but can save you lakhs in the long run. Thirdly, it serves as a powerful motivational tool. Seeing tangible numbers – the exact amount of interest saved, the specific number of years shaved off your loan – provides a strong incentive to stick to your prepayment plan, especially when the journey seems long. It turns an abstract goal into a concrete, achievable target. Furthermore, these calculators help you understand the critical importance of *when* you make prepayments. Prepayments made earlier in the loan tenure have a much larger impact on interest savings because the principal balance is higher. A calculator vividly illustrates this principle. Whether you are planning to make small, regular prepayments or occasional larger ones, using a home loan prepayment calculator (like the one available at http://homeloanprepaymentcalculator.site/) should be a non-negotiable first step. It transforms you from a passive EMI payer into an active, informed manager of your home loan, putting you firmly in control of your financial destiny.

Standard EMI Plan vs. Strategic Prepayment Plan

This table clearly illustrates that while a strategic prepayment plan requires more discipline and a slightly higher regular outflow, the long-term benefits in terms of interest saved, tenure reduction, and overall financial well-being are overwhelmingly superior. The choice is between a seemingly easier path that costs a fortune and a more engaged approach that leads to substantial savings and earlier financial freedom. Using a home loan prepayment calculator can help you model your own strategic plan and see these benefits firsthand.

Pros and Cons of Home Loan Prepayment

Pros:

- Massive Interest Savings: This is the most significant advantage. By reducing the principal amount faster, you pay less interest over the life of the loan, potentially saving lakhs or even tens of lakhs of rupees.

- Reduced Loan Tenure: Prepayments can drastically shorten the loan period, allowing you to become debt-free much earlier than planned. This frees up your future income for other investments or goals.

- Increased Equity in Your Home: As you pay down the principal faster, your equity in the property increases more rapidly, enhancing your net worth.

- Financial Freedom and Peace of Mind: Clearing a large debt like a home loan brings immense psychological relief and a sense of financial security and freedom.

- Improved Credit Score: While not a direct outcome, a history of consistent loan payments, including prepayments, can reflect positively on your creditworthiness over time, though the primary impact is from regular EMI payments.

- Flexibility (with Partial Prepayments): Many lenders offer flexibility in making partial prepayments, allowing you to pay extra when you have surplus funds without altering your EMI structure if you choose tenure reduction.

- Hedge Against Interest Rate Hikes: For those on floating rate loans, reducing the principal quickly provides a buffer against potential increases in interest rates, as the impact of such hikes will be on a lower outstanding balance.

- Option to Reduce EMI or Tenure: Most lenders offer a choice when you make a prepayment: you can either reduce your EMI while keeping the tenure the same, or keep the EMI the same and reduce home loan tenure. The latter usually results in greater interest savings.

Cons:

- Prepayment Penalties: Some loans, particularly fixed-rate home loans or those from certain non-banking financial companies (NBFCs), may attract prepayment penalties. It's crucial to check your loan agreement (RBI has restricted these for individual floating rate loans).

- Opportunity Cost of Funds: The money used for prepayment could potentially be invested elsewhere (e.g., mutual funds, stocks) to earn higher returns than the interest saved on the loan. This requires careful evaluation of risk and return.

- Liquidity Reduction: Committing significant funds to prepayment reduces your liquid cash reserves, which might be needed for emergencies or other immediate financial needs. Maintaining an adequate emergency fund is vital.

- Loss of Tax Benefits (Marginal): Home loans offer tax deductions on both principal repayment (Section 80C) and interest paid (Section 24b). Early loan closure means these benefits cease sooner. However, the interest saved through prepayment usually far outweighs the tax benefits forgone, especially for higher interest rates.

- Minimum Prepayment Amount: Some lenders may have a minimum amount for partial prepayments, which might not always be feasible for everyone on a regular basis.

- Effort and Discipline: Strategic prepayment requires conscious planning, financial discipline, and consistent effort, which might be challenging for some individuals.

- Impact on Other Financial Goals: Over-aggressively prepaying a home loan at the expense of other critical financial goals like retirement planning, children's education funding, or adequate insurance coverage might not be a balanced approach.

Key Takeaways & Tips

💡 Tip: Maximize Your Prepayment Impact! Always opt for tenure reduction instead of EMI reduction when making a prepayment. While a lower EMI might seem tempting, reducing the loan tenure leads to significantly greater interest savings in the long run. Also, make prepayments as early in the loan tenure as possible for the biggest impact!

⚠️ Warning: Check for Prepayment Charges & Lock-ins! Before making any prepayment, carefully review your loan agreement or contact your lender to understand if any prepayment penalties or lock-in periods apply. This is especially important for fixed-rate loans or loans from some housing finance companies. Being aware can save you from unexpected costs.

🌟 Feature: The Power of Consistency with a Home Loan Prepayment Calculator! Even small, regular prepayments add up to substantial savings over time. Use a home loan prepayment calculator (like the one at http://homeloanprepaymentcalculator.site/) to visualize this. Consistency is more powerful than sporadic large payments. Set a realistic additional amount you can pay monthly or quarterly and stick to it!

Ready to take control of your home loan and potentially save lakhs in interest? Stop letting interest eat away at your financial future! Discover exactly how much you can save and how quickly you can become debt-free.

➡️ Calculate Your Savings Now! Try our free Home Loan Prepayment Calculator! ⬅️

Take the first step towards a debt-free life today. Empower yourself with knowledge and the right tools to save interest on home loan and reduce home loan tenure effectively!

Frequently Asked Questions (FAQs)

Q: What is the minimum amount I can typically prepay on my home loan?

A: The minimum amount for partial prepayment can vary from lender to lender. Some banks may allow prepayments as low as one EMI, while others might have a higher threshold, like two or three times the EMI, or a fixed minimum sum (e.g., ₹10,000 or ₹25,000). It's best to check your loan agreement or directly with your lender for their specific policy. Many online prepayment portals also specify the minimum allowed amount when you initiate a transaction.

Q: Are there any tax benefits associated with home loan prepayment?

A: While the act of prepayment itself doesn't offer additional tax benefits, the principal portion of your prepayment (along with the principal component of your regular EMIs) is eligible for deduction under Section 80C of the Income Tax Act, up to the overall limit of ₹1.5 lakhs per financial year. However, if you prepay and close your loan early, you will cease to receive the annual tax benefits on interest paid (under Section 24b) and principal repayment for the remaining original tenure. The substantial interest saved through prepayment often outweighs the loss of future tax benefits, but it's a factor to consider. A housing loan part payment calculator can help you see the net savings.

Q: How many times can I make partial prepayments on my home loan in a year?

A: Most lenders allow multiple partial prepayments in a year, and many do not have a strict upper limit on the number of times you can prepay. However, some might have restrictions, such as allowing it once a quarter or having a minimum gap between prepayments. With online banking and digital processing, making prepayments has become much easier and more frequent. Always confirm your lender's specific policy. The key is consistency that fits your financial flow.

Q: Should I prepay my home loan or invest the surplus money elsewhere for higher returns?

A: This is a common dilemma and depends on your risk appetite and the potential post-tax returns from investments versus the interest rate on your home loan. If you can confidently earn a higher post-tax return from investments than the interest rate you are paying on your home loan, investing might seem attractive. However, home loan prepayment offers a guaranteed, risk-free saving (the loan interest rate). Investments carry market risks. For many risk-averse individuals, the guaranteed saving and peace of mind from reducing debt are preferable. It's often advisable to strike a balance: allocate some funds for prepayment and some for wealth-creating investments. Consulting a financial advisor can help you make a decision tailored to your profile.