Introduction: Taking Control of Your Home Loan Journey

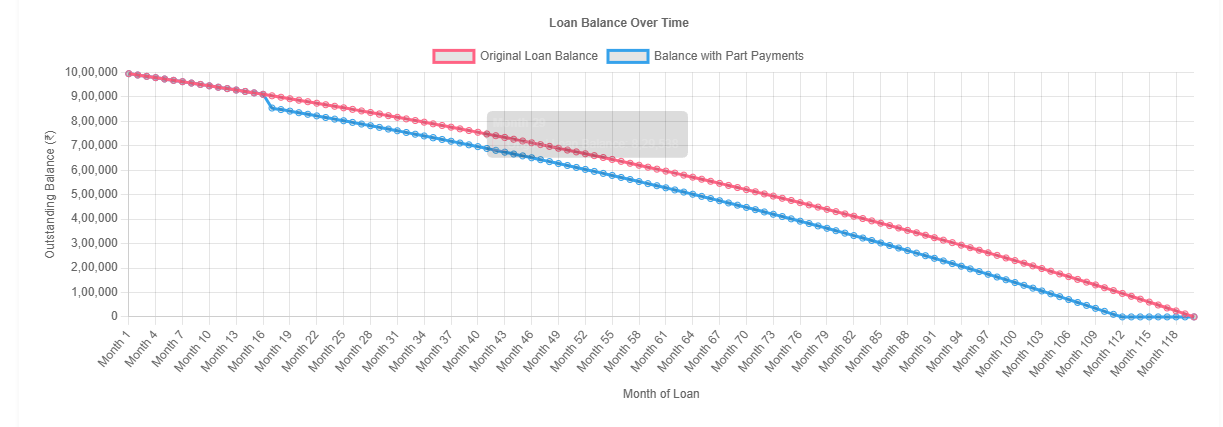

Embarking on the journey of homeownership is a significant milestone, often accompanied by the long-term commitment of a home loan. While regular Equated Monthly Instalments (EMIs) are the standard path to repayment, a powerful yet often underutilized strategy exists: making part payments. This approach involves paying an amount over and above your scheduled EMI, directly targeting the principal loan amount. The impact of such payments can be profound, leading to substantial interest savings, a shorter loan duration, and ultimately, a quicker route to becoming debt-free. Understanding the nuances of part payments empowers you to take proactive control of your financial future, transforming your home loan from a lengthy obligation into a more manageable and flexible financial tool. Many borrowers wonder about the best way to reduce home loan tenure, and part payments offer a compelling solution. This blog post will delve deep into the benefits of making part payments on your home loan, explore how they can significantly reduce your loan tenure, clarify any restrictions, differentiate them from full prepayments, and discuss the convenience of automatic deductions. We will also provide insights into effective home loan repayment planning to help you make informed decisions.

The concept of a home loan often brings to mind decades of consistent payments. However, with strategic financial planning, including the use of a home loan prepayment calculator, you can significantly alter this timeline. Part payments act as a catalyst in this process, chipping away at the principal amount more aggressively than standard EMIs alone. This not only reduces the outstanding balance but also curtails the total interest payable over the life of the loan. For instance, even a modest additional payment made periodically can translate into thousands, if not lakhs, of rupees saved in interest and several years shaved off your loan term. This financial leverage is crucial, especially in an economic environment where interest rates can fluctuate. By actively managing your loan through part payments, you are not just a passive borrower but an active participant in your financial well-being, steering towards a future with reduced debt and increased financial freedom. This is a key aspect of home loan financial planning.

The Multifaceted Benefits of Making Part Payments

Making part payments on your home loan isn't just about reducing debt; it's a strategic financial move with a cascade of positive effects. One of the most significant advantages is the substantial reduction in the total interest paid over the loan's lifetime. Since interest is calculated on the outstanding principal, every part payment directly reduces this principal, thereby lowering the subsequent interest charges. This can lead to considerable savings, freeing up funds for other investments or financial goals. Utilizing a home loan interest savings tool can help you visualize these potential savings. Furthermore, consistent part payments can dramatically shorten your loan tenure. Imagine becoming mortgage-free years ahead of schedule! This not only provides immense peace of mind but also enhances your financial flexibility for future endeavors. The ability to save interest on home loan is a primary motivator for many borrowers to opt for part payments.

Beyond the direct financial gains, making part payments also improves your overall financial health. It contributes to building home equity faster. Equity is the difference between your home's market value and your outstanding loan amount. As you pay down the principal more rapidly through part payments, your equity stake in the property increases at an accelerated pace. This increased equity can be a valuable asset, potentially leveraged for future financial needs like funding education, home renovations, or even as collateral for other loans under more favorable terms. Moreover, a lower outstanding loan balance positively impacts your debt-to-income ratio, a key metric lenders use to assess creditworthiness. A healthier debt-to-income ratio can open doors to better credit opportunities and lower interest rates on future borrowings. Many individuals use a principal reduction calculator to understand how quickly they can build equity. This proactive approach to loan management demonstrates financial discipline, which is always viewed favorably by financial institutions.

Accelerating Your Journey to Debt-Free: How Part Payments Reduce Loan Tenure

One of the most compelling reasons to make part payments on your home loan is the potential to significantly reduce home loan tenure. Every extra rupee paid towards your principal loan amount works to shorten the overall duration of your loan. Unlike regular EMIs, where a substantial portion initially goes towards servicing interest, part payments are typically applied directly to the principal. This direct reduction of the principal means that the base on which future interest is calculated shrinks faster. Consequently, you pay off the loan much sooner than the originally scheduled term. Imagine the relief and financial freedom of owning your home outright several years earlier than planned! This acceleration is not just a minor adjustment; it can translate into a substantial reduction in the number of payments you need to make. Using a housing loan part payment calculator can provide a clear projection of how much your tenure can be reduced based on different part payment scenarios.

The mechanics behind tenure reduction are straightforward but powerful. When you make a part payment, your lender will typically give you two options: either reduce your EMI amount while keeping the tenure the same, or keep the EMI the same and reduce the loan tenure. For those aiming to become debt-free sooner, opting for tenure reduction is usually the more impactful choice. By maintaining the same EMI level but applying part payments, you are essentially making larger principal repayments each month, which rapidly amortizes the loan. This strategy is particularly effective in the early to middle stages of the loan when the interest component of your EMI is highest. An early loan repayment calculator can be an invaluable tool in understanding the precise impact of your part payments on the loan's lifespan. The satisfaction of seeing your loan term shrink, bringing you closer to full ownership of your home, is a significant psychological and financial victory. This proactive approach to home loan repayment planning empowers borrowers to take control of their financial destiny.

Navigating the Fine Print: Understanding Restrictions on Part Payments

While making part payments on a home loan is generally encouraged and beneficial, it's crucial to be aware of potential restrictions or conditions that lenders might impose. These can vary from one financial institution to another, so thoroughly reviewing your loan agreement or consulting with your lender is paramount. Some common restrictions can pertain to the frequency of part payments allowed within a year, or the minimum and maximum amount that can be paid as a part payment in a single transaction. For instance, a lender might stipulate that part payments can only be made a certain number of times annually, or that each part payment must be at least equivalent to, say, three EMIs. Understanding these limitations upfront helps in effective home loan repayment planning and prevents any surprises. Some lenders might also have specific windows or methods for accepting part payments, such as through designated online portals or specific branch transactions. Being aware of these procedural aspects ensures a smooth process when you decide to make an additional payment. It's also worth checking if there are any processing fees associated with making part payments, although for floating rate home loans, the Reserve Bank of India (RBI) has disallowed prepayment penalties, which generally extends to part payments as well. However, fixed-rate loans might still attract some charges. A mortgage prepayment calculator India can sometimes factor in these nuances if specified by the lender.

Another aspect to consider is how the lender applies the part payment. Typically, you'll have the option to either reduce your EMI or reduce the loan tenure. If your goal is to become debt-free faster and save interest on home loan, opting for tenure reduction is usually the more advantageous path. However, some lenders might have a default option, so it's important to communicate your preference clearly. Additionally, there might be a lock-in period during the initial phase of the loan (e.g., the first year) during which part payments are not allowed or are subject to higher charges. This is less common now for floating rate loans but can still be a factor for certain loan products or lenders. Always ask for clarification on these points. The key is to have a clear understanding of your lender's specific policies regarding part payments to maximize the loan prepayment benefits without incurring unexpected costs or facing procedural hurdles. Tools like an EMI reduction calculator can help you analyze the impact of choosing EMI reduction versus tenure reduction, but your primary goal should align with your long-term financial strategy.

Part Payment vs. Full Prepayment: Understanding the Key Differences

When exploring options to pay down your home loan faster, you'll often encounter two terms: part payment and full prepayment (or foreclosure). While both aim to reduce your loan burden, they differ significantly in their scope and implications. A part payment, as we've discussed, involves paying a lump sum amount that is less than the total outstanding principal, over and above your regular EMIs. This reduces the principal, leading to either lower EMIs or a shorter tenure. It's a flexible approach that allows you to make additional payments as and when you have surplus funds, without necessarily closing the loan account entirely. Many borrowers use a part prepayment impact calculator to see how these smaller, periodic payments can accumulate to create significant savings over time. This method offers a gradual way to reduce your debt while maintaining the loan. The loan prepayment benefits are still substantial, even with partial payments.

Full prepayment, on the other hand, means paying off the entire outstanding loan balance in one single payment before the end of the official loan tenure. This action closes your loan account completely, making you debt-free from that particular obligation. This is often done when a borrower receives a substantial windfall, such as a large bonus, inheritance, or proceeds from the sale of another asset. While the ultimate goal of becoming debt-free is achieved much faster with full prepayment, it requires a significant amount of capital. Part payments offer a more accessible route for those who may not have such large sums available at once but can still make smaller, impactful contributions. It's important to compare prepayment scenarios using tools like a home loan EMI calculator with prepayment to understand which approach best suits your financial situation and long-term goals. Both strategies offer ways to save on interest and achieve financial freedom sooner, but their suitability depends on individual financial capacity and objectives. For many, the consistent, manageable approach of part payments, guided by a sound home loan financial planning strategy, is the more practical path.

The Convenience of Automation: Setting Up Automatic Part Payments

In today's fast-paced world, convenience and automation are highly valued, and managing your home loan part payments can also benefit from these principles. Many lenders now offer facilities to automate your part payments, making the process seamless and ensuring you stay on track with your accelerated repayment goals. Setting up automatic deductions means that a pre-determined additional amount is debited from your bank account and applied towards your home loan principal on a regular basis, often alongside your standard EMI. This 'set it and forget it' approach can be incredibly effective, as it removes the need to manually make extra payments each time, reducing the chances of oversight or procrastination. This is a crucial component of effective home loan repayment planning, as consistency is key to maximizing the benefits of part payments. Before setting this up, it's wise to use a home loan prepayment calculator to determine a comfortable yet impactful additional amount that you can commit to regularly without straining your monthly budget.

To enable automatic part payments, you typically need to provide a standing instruction or an Electronic Clearing Service (ECS) mandate to your bank or lending institution. This authorizes them to deduct the specified additional sum on chosen dates. Some banks might integrate this feature into their net banking platforms, allowing you to set up or modify such instructions online with ease. It's important to check with your lender about the specific procedures, any applicable charges (though usually minimal or nil for this service), and the flexibility offered. For example, can you easily pause or change the amount of the automatic part payment if your financial circumstances change? Understanding these aspects ensures that the automation works for you, not against you. By automating part payments, you are consistently working to reduce home loan tenure and save interest on home loan, making steady progress towards financial freedom without requiring constant active intervention. This disciplined approach, facilitated by technology, can make a substantial difference in your home loan journey, helping you achieve your goal of an early loan repayment calculator much more efficiently.

Deeper Dive: Unpacking More Advantages of Strategic Part Payments

Beyond the primary benefits of interest reduction and tenure shortening, strategic part payments offer several other nuanced advantages that contribute significantly to your long-term financial well-being. One such benefit is the enhanced psychological comfort that comes from actively reducing your debt. Carrying a large home loan for decades can be a source of stress for many. By making part payments, you gain a sense of control over your finances and see tangible progress towards becoming debt-free, which can be incredibly empowering. This proactive stance often translates into better financial discipline in other areas of life as well. When considering these payments, a home loan prepayment calculator can be a great motivator, showing you exactly how each extra payment chips away at the loan. This visual reinforcement can be very powerful.

Furthermore, while the direct impact of part payments on your credit score might not be immediate or dramatic (as timely EMI payments are the primary factor), consistently reducing your overall debt burden contributes positively to your credit profile in the long run. A lower debt-to-income ratio, achieved through accelerated principal repayment, makes you a more attractive borrower for future credit needs. Lenders view individuals who manage their debts proactively and efficiently with greater confidence. This can lead to more favorable terms, such as lower interest rates or higher loan amounts, should you require financing for other significant life events or investments. Effective home loan financial planning, which includes strategic part payments, therefore, has a ripple effect on your overall financial standing. It's not just about the current loan; it's about building a stronger financial future. Many also find that using a principal reduction calculator helps them stay focused on this goal, as it clearly illustrates the decreasing debt and increasing equity.

Another often overlooked benefit is the mitigation of risk associated with long-term interest rate fluctuations, especially if you are on a floating rate home loan. While floating rates can sometimes be lower than fixed rates, they are susceptible to market changes. By making part payments and reducing your principal faster, you lessen your exposure to potential increases in interest rates over the loan's tenure. A smaller principal means that even if rates rise, the impact on your interest outflow will be less severe compared to a scenario where the principal remains high. This proactive debt reduction acts as a financial buffer, providing greater stability and predictability in your loan repayment journey. This is a smart way to save interest on home loan even in a volatile market. The peace of mind that comes from knowing you are actively managing these risks is invaluable.

Part Payment vs. Full Prepayment: A Detailed Comparison

To help you better understand the nuances between making part payments and opting for a full prepayment of your home loan, we've created a detailed comparison table. This table highlights the key characteristics, benefits, and considerations for each approach. Choosing the right strategy depends on your individual financial situation, goals, and the terms offered by your lender. A home loan prepayment calculator can be instrumental in modeling different scenarios before making a decision. Remember, effective home loan repayment planning involves understanding all available options.

| Feature | Part Payment | Full Prepayment (Foreclosure) |

|---|---|---|

| Definition | Paying an additional amount over and above the regular EMI, which is less than the total outstanding principal. | Paying off the entire outstanding loan balance in a single payment before the scheduled end of the tenure. |

| Impact on Loan | Reduces the outstanding principal. Borrowers can typically choose to either reduce the EMI or shorten the loan tenure. | Completely closes the loan account. The borrower becomes debt-free from this particular loan. |

| Flexibility | Highly flexible. Can be done multiple times when surplus funds are available. Amounts can vary. | Less flexible. Requires a single, large lump sum payment to clear the entire debt. |

| Capital Required | Requires smaller, manageable lump sums. More accessible for regular savers or those with periodic bonuses. | Requires a significant amount of capital, often from a major windfall (e.g., inheritance, asset sale). |

| Interest Savings | Leads to significant interest savings over time, especially if done consistently and early in the loan tenure. Helps to save interest on home loan. | Maximizes interest savings as all future interest payments are eliminated. |

| Tenure Reduction | Can significantly reduce home loan tenure if that option is chosen over EMI reduction. | Loan tenure effectively becomes zero upon prepayment. |

| Prepayment Charges/Penalties | Generally, no prepayment charges for floating rate home loans in India. Fixed-rate loans might have charges. | Similar to part payments; no charges for floating rate loans, potential charges for fixed-rate loans. |

| Frequency | Can be done multiple times, subject to lender policies (e.g., minimum amount, number of times per year). | A one-time event that settles the loan. |

| Suitability | Suitable for borrowers who want to proactively reduce their loan burden with periodic surplus funds without needing to close the loan immediately. Good for long-term home loan financial planning. | Suitable for borrowers who have access to a large sum of money and wish to become completely debt-free from the home loan quickly. |

| Tools for Assessment | Housing loan part payment calculator, part prepayment impact calculator. | Mortgage prepayment calculator India, early loan repayment calculator. |

Ultimately, the decision to make part payments or a full prepayment should be based on a careful evaluation of your financial capacity, liquidity needs, investment opportunities, and overall financial goals. It is always advisable to compare prepayment scenarios and consult with a financial advisor to make the most informed choice. Both strategies offer powerful loan prepayment benefits when applied correctly.

Weighing Your Options: Pros and Cons of Home Loan Part Payments

Making part payments on your home loan is a significant financial decision that comes with its own set of advantages and potential drawbacks. Understanding these can help you make an informed choice that aligns with your financial strategy. A home loan EMI calculator with prepayment can help illustrate many of these points numerically, allowing you to see the tangible impact of part payments.

Pros of Making Part Payments:

- Significant Interest Savings: This is often the biggest motivator. By reducing the principal amount faster, you pay less interest over the life of the loan. This is a direct way to save interest on home loan.

- Reduced Loan Tenure: Opting to reduce the tenure means you become debt-free much sooner, freeing up cash flow for other investments or life goals. This is a key benefit for those looking to reduce home loan tenure.

- Increased Home Equity: As you pay down the principal more quickly, your equity in the property builds faster. This increases your net worth and can be leveraged for future financial needs.

- Lower Financial Burden: A smaller outstanding loan or a shorter repayment period can significantly reduce financial stress and provide peace of mind.

- Improved Debt-to-Income Ratio: Reducing your loan obligations can improve your debt-to-income ratio, potentially making it easier to secure other forms of credit on favorable terms.

- Flexibility: Part payments offer flexibility. You can make them when you have surplus funds, unlike the rigid structure of only EMIs. Many use a housing loan part payment calculator to plan these flexible payments.

- Protection Against Interest Rate Hikes: For those on floating rate loans, reducing the principal quickly can mitigate the impact of future interest rate increases.

- Psychological Boost: Actively reducing debt and seeing tangible progress towards loan closure can be very motivating and empowering. This is an important aspect of home loan financial planning.

Cons of Making Part Payments:

- Liquidity Reduction: Making a lump sum part payment reduces your liquid cash reserves, which might be needed for emergencies or other immediate financial obligations.

- Opportunity Cost: The funds used for part payment could potentially be invested elsewhere for higher returns (e.g., mutual funds, stocks). It's essential to compare prepayment scenarios against potential investment returns.

- Potential Prepayment Penalties (for certain loans): While floating rate loans in India typically don't have prepayment penalties, some fixed-rate loans or specific loan agreements might still impose charges.

- Minimum Payment Restrictions: Lenders may have rules regarding the minimum amount for a part payment or the frequency, which might not always align with your available surplus.

- Loss of Tax Benefits (Marginal): Home loan principal and interest payments offer tax deductions under sections 80C and 24(b) of the Income Tax Act, respectively. Paying off the loan faster means these benefits will cease sooner. However, the interest saved usually outweighs the tax benefits lost.

- Complexity in Management: While generally straightforward, managing part payments requires some planning and coordination with the lender to ensure they are applied correctly (e.g., towards principal, choice of EMI or tenure reduction).

Evaluating these pros and cons in the context of your personal financial situation is crucial. Tools like a part prepayment impact calculator or an early loan repayment calculator can provide quantitative insights to aid your decision-making process. The ultimate goal is to make a choice that enhances your financial well-being and helps you achieve your homeownership and debt-freedom goals efficiently.

Key Takeaways & Pro Tips

Navigating the world of home loan repayments can be complex, but with the right strategies, you can significantly ease your journey. Here are some key takeaways and pro tips to help you make the most of home loan part payments. Remember, consistent home loan repayment planning is crucial for success.

Pro Tip: Start Early! The earlier you start making part payments in your loan tenure, the greater the impact on interest savings and tenure reduction. Even small, regular part payments made from the beginning can make a huge difference over time. Use a home loan prepayment calculator to see the long-term benefits.

Warning: Check for Charges! While RBI has disallowed prepayment penalties on floating rate home loans, always verify with your lender if any processing fees or other charges apply to part payments, especially for fixed-rate loans or specific products. This avoids any unexpected costs when trying to save interest on home loan.

Feature Spotlight: Tenure Reduction vs. EMI Reduction. When making a part payment, lenders usually offer a choice between reducing your EMI or reducing your loan tenure. If your goal is to become debt-free faster and save more on interest, opting for tenure reduction is generally more beneficial. An EMI reduction calculator can help you compare, but prioritize tenure reduction for faster principal reduction calculator benefits.

Pro Tip: Automate Your Part Payments. If your lender allows, set up standing instructions for automatic part payments. This ensures consistency and discipline in your repayment strategy, helping you reduce home loan tenure effortlessly.

Frequently Asked Questions (FAQs)

Here are answers to some common questions about making part payments on home loans. Understanding these can help you navigate the process more effectively and make informed decisions. For specific scenarios, a home loan EMI calculator with prepayment can provide personalized insights.

The minimum amount for a part payment varies from lender to lender. Some banks may require the part payment to be at least equivalent to one or more EMIs (e.g., 2 or 3 EMIs), while others might have a fixed minimum sum (e.g., ₹25,000 or ₹50,000). It is crucial to check your loan agreement or directly ask your lender about their specific policy on minimum part payment amounts. This information is vital for effective home loan repayment planning.

The frequency of part payments allowed per year also depends on the lender's policy. Some lenders may allow unlimited part payments, while others might restrict it to a certain number of times annually (e.g., 2-4 times). Always confirm this with your bank. Knowing this helps you plan your surplus fund utilization better and maximize the loan prepayment benefits.

Making part payments itself does not negatively affect your credit score. In fact, consistently reducing your debt and managing your loan responsibly can positively influence your credit profile in the long term by improving your debt-to-income ratio. Timely payment of regular EMIs is the most critical factor for a good credit score. Part payments are a sign of good financial health.

This depends on your overall financial situation, including your emergency fund, other investment opportunities, and risk appetite. While part payments help save interest on home loan, it's crucial not to deplete your emergency savings. Consider the interest rate on your loan versus potential returns from other investments. If the loan interest rate is high, prepayment can be very beneficial. A mortgage prepayment calculator India can help you analyze the financial impact.

The process for making a part payment typically involves informing your bank or lending institution through their prescribed channels. This could be via their online banking portal, by visiting a branch and submitting a request form, or through customer care. You will usually need to specify the amount and whether you want to reduce the EMI or the loan tenure. Check your lender's specific procedure. Using a housing loan part payment calculator beforehand can help you decide on the amount.

If your primary goal is to save the maximum amount of interest and become debt-free sooner, reducing the loan tenure is generally the more advantageous option. Keeping the EMI the same while shortening the tenure accelerates principal repayment. However, if you prefer lower monthly outgoings for better cash flow, EMI reduction might be suitable. An EMI reduction calculator can show you the difference, but for significant interest savings and to reduce home loan tenure, the latter is preferred.

Ready to Take Control of Your Home Loan?

Understanding the benefits and mechanics of part payments is the first step towards a smarter home loan strategy. Don't let your loan dictate your financial future. Take proactive steps, explore your options, and see how you can save significantly and achieve debt freedom sooner.

Use our comprehensive home loan prepayment calculator to explore different scenarios and see your potential savings. Plan your path to an earlier mortgage payoff today!

Try Our Home Loan Prepayment Calculator Now!For more detailed home loan financial planning advice, consider consulting with a financial advisor.